Trusted by hundreds of top organisations

Solutions Overview

AI Avatar self-service Kiosk

Answering a challenge The High Price of Manual Processes in Banking Operations

Inefficient manual processes and inadequate customer data management create operational bottlenecks that disrupt service delivery, leading to longer wait times and a lack of personalized service. Additionally, the absence of effective customer authentication systems raises the risk of fraud, potentially costing banks billions annually. Together, these issues undermine profitability and hinder the bank's ability to compete effectively.

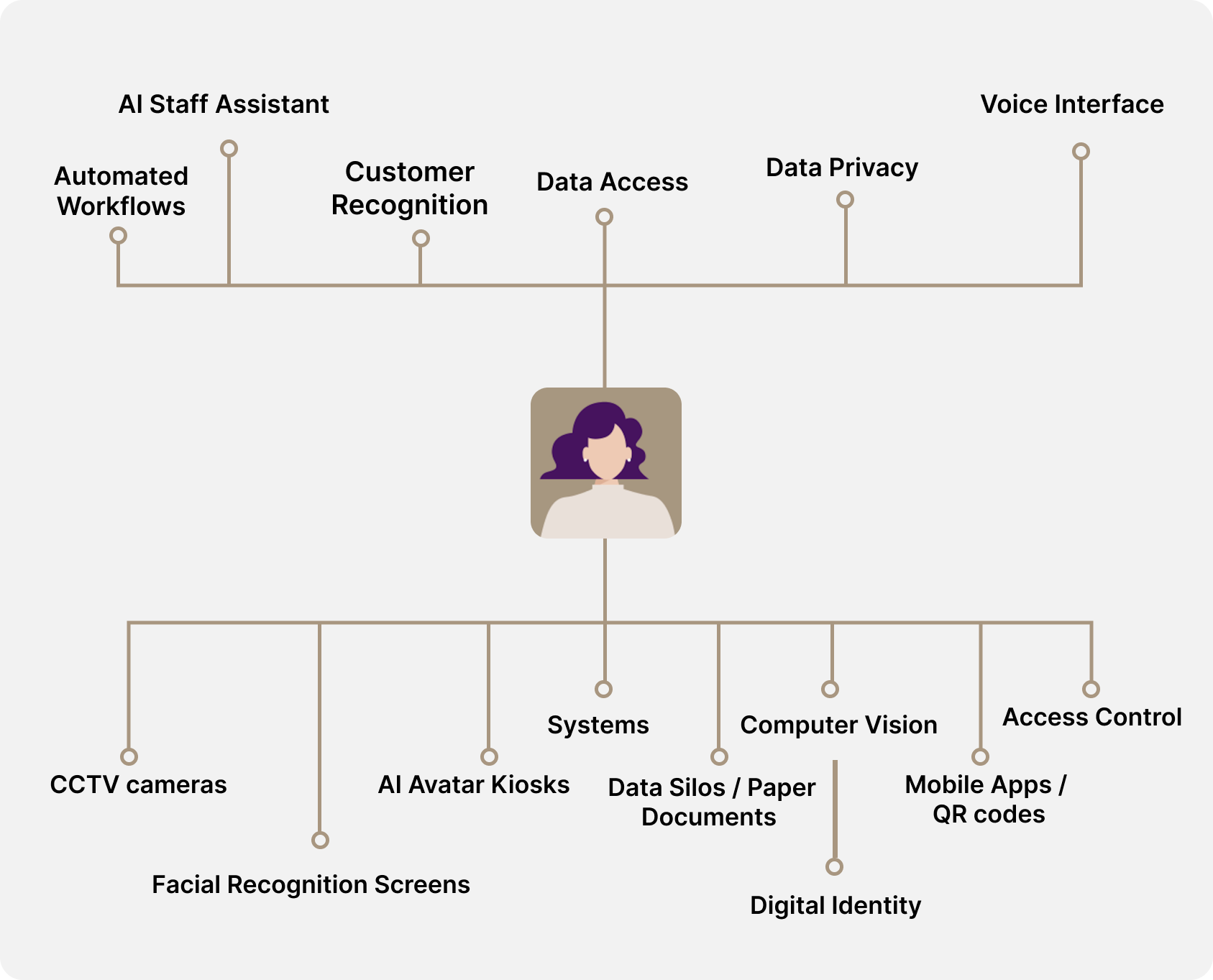

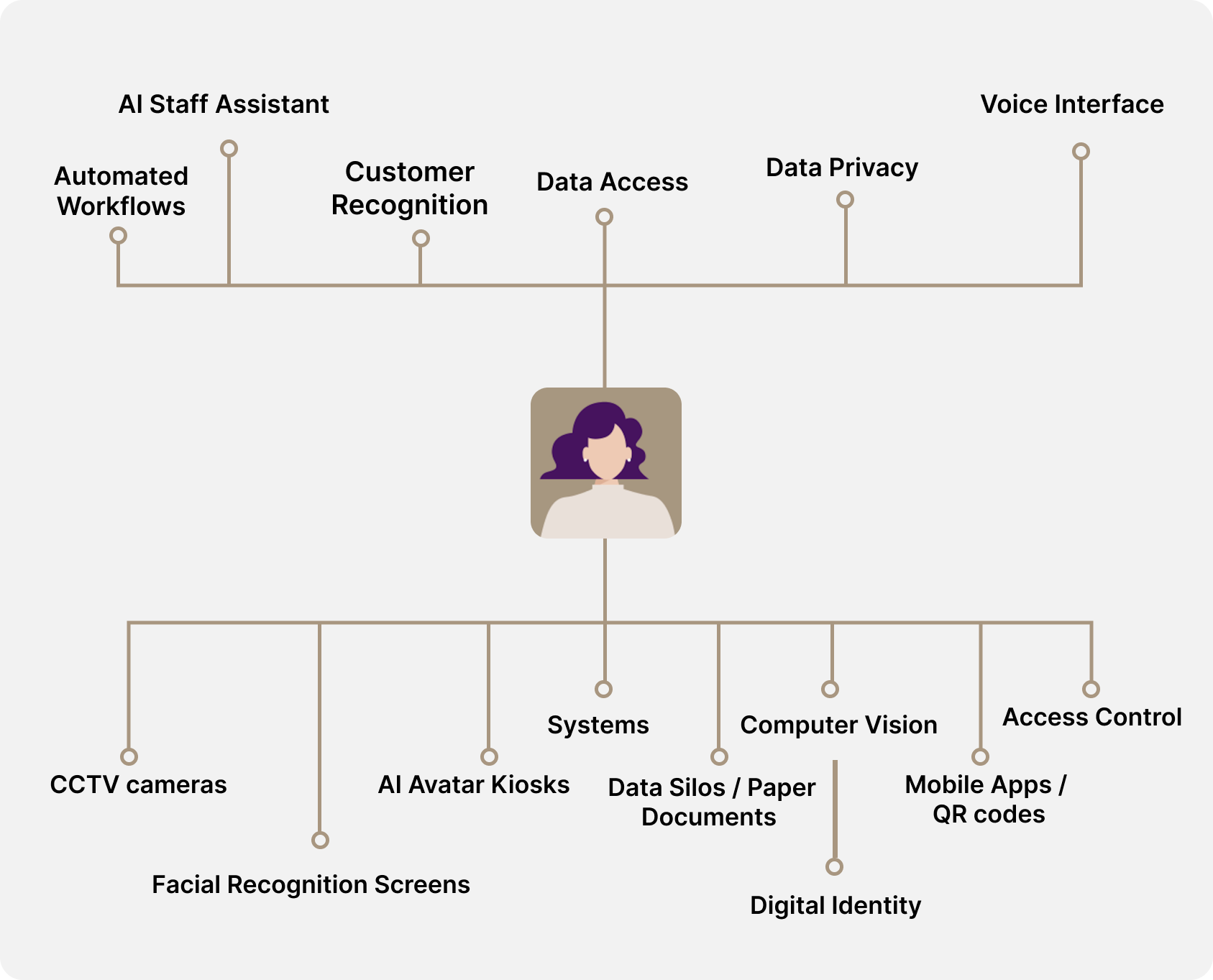

Meet Gaia Seamless Customer Identification and AI Operational Assistant

Gaia is a platform that uses AI and computer vision to authenticate customers, elevate their in-branch experiences and gain operational efficiency

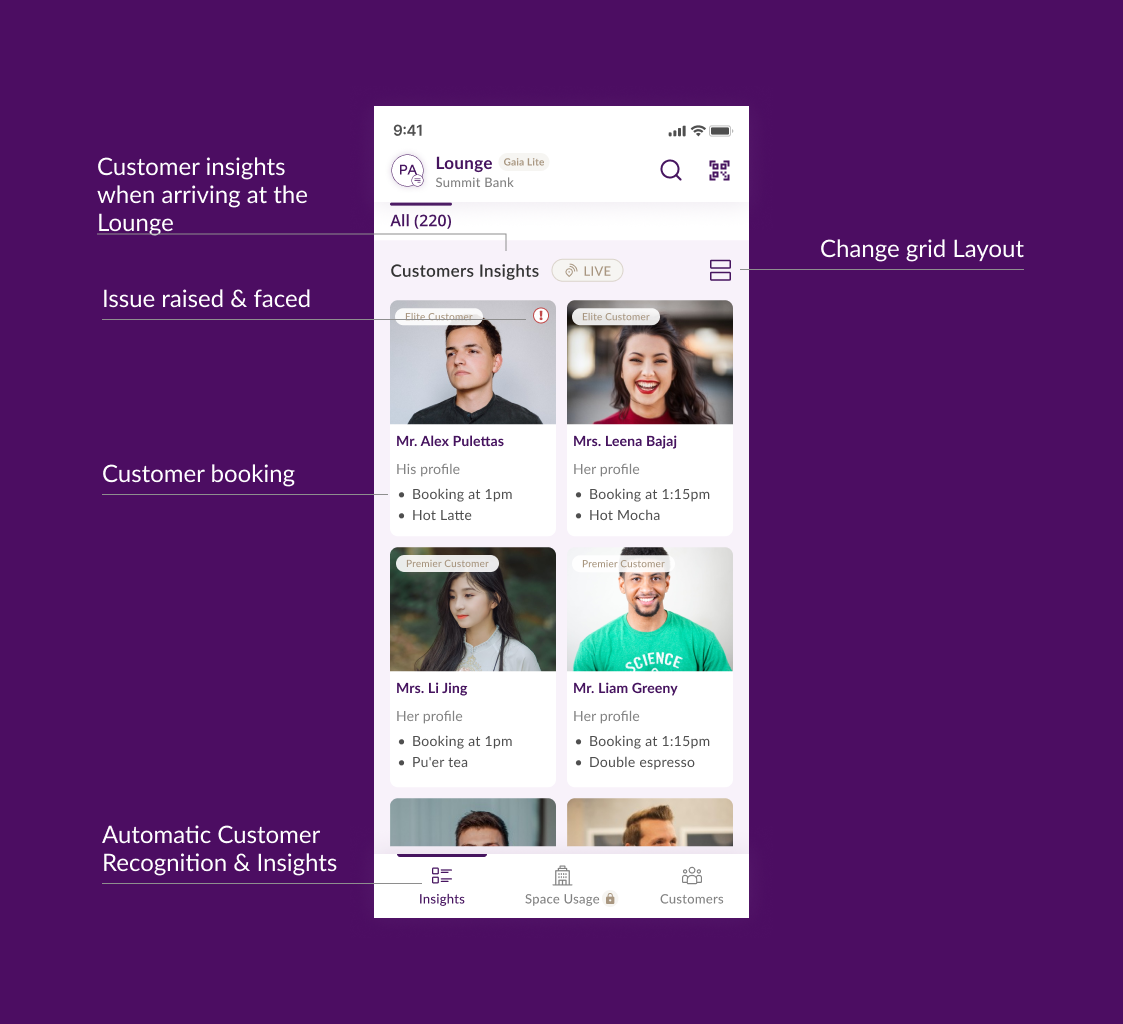

Customer Recognition Fast and Personalised In-Branch Experience

- Customer facial recognition at branch entrances, teller counters and concierge desks

- Instant recognition: profile appears within 0.02 sec with banking details, appointment and preferences

- Reduces wait time by streamlining the check-in process, enabling quicker service delivery

- Improved customer satisfaction: Personalized interactions foster a sense of belonging, increasing customer loyalty

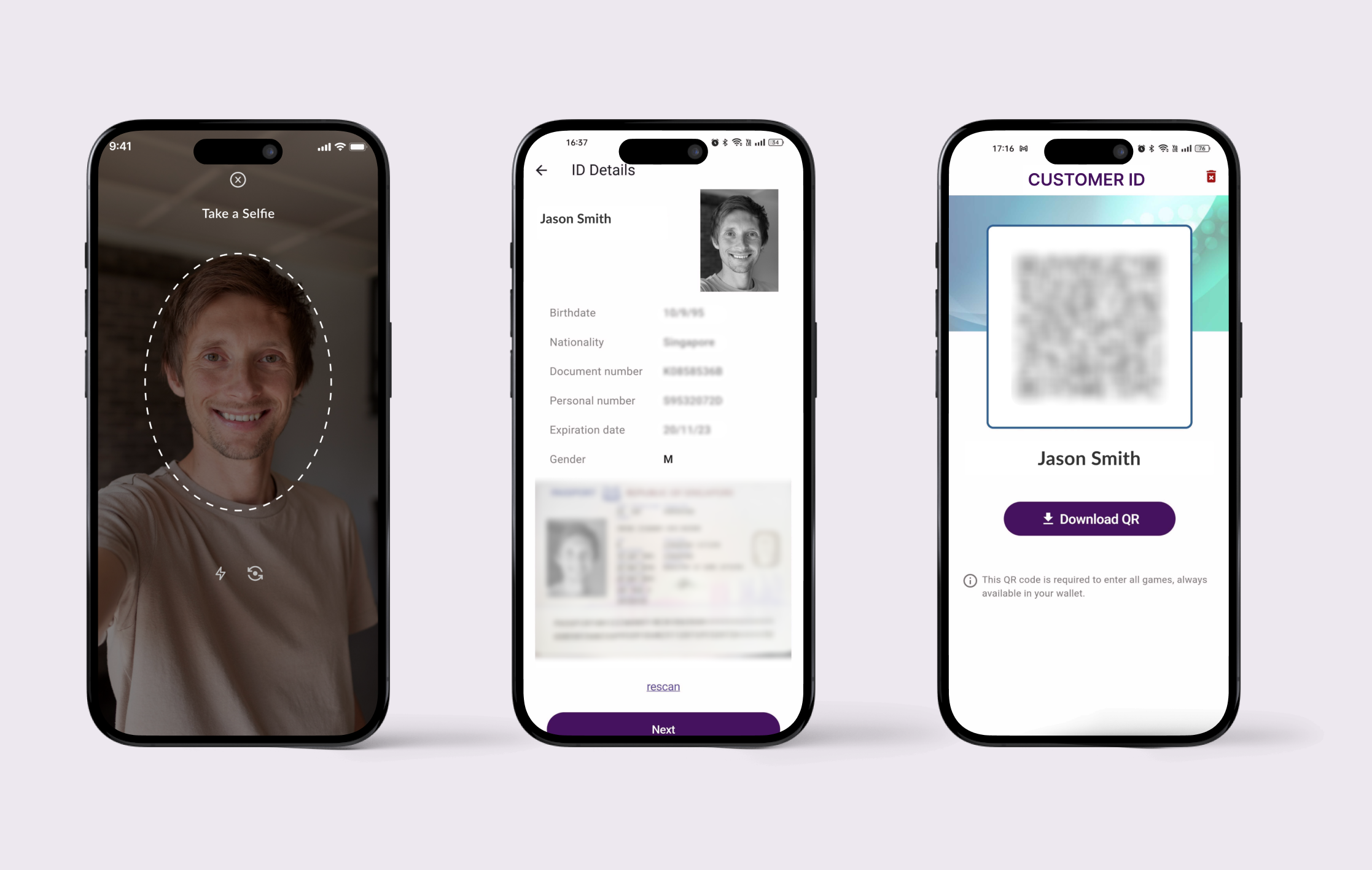

Customer digital identity Effortless Identity Verification

- In partnership with Regula and their Document Reader and Face SDK for banks

- Face and document liveness detection

- Active authenticity control

- 13,000+ ID templates issued in 247 countries and territories

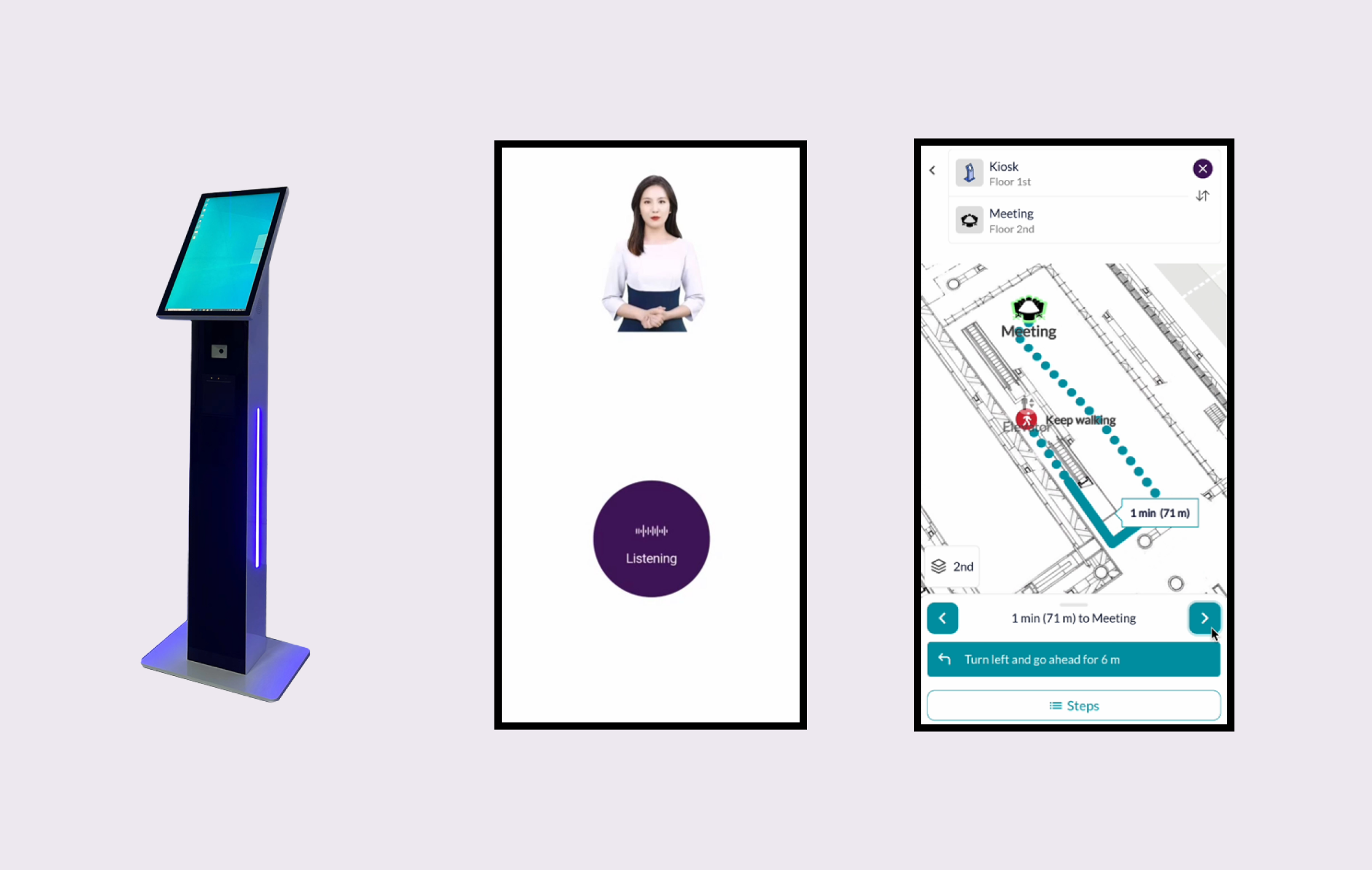

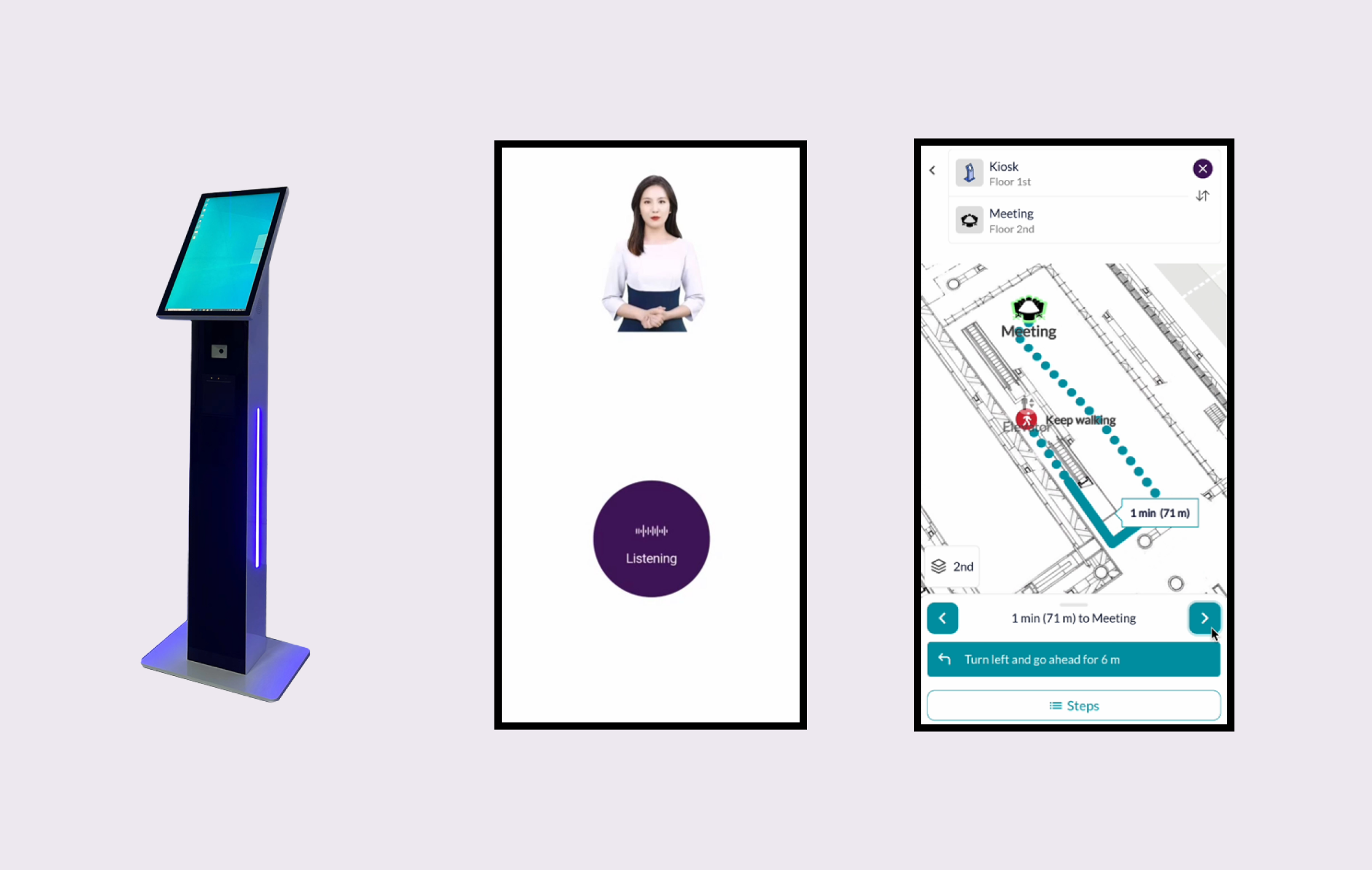

AI Avatar Kiosk World-class self-service with AI Avatar Kiosk

- Voice command interaction: Enables effortless engagement with banking services, also improving accessibility for individuals with disabilities and those facing challenges with traditional interfaces.

- Features: touch-screen, built-in camera, acoustic echo cancellation, voice tracking, QR code scanner, printer

- Streamlined service delivery: By automating routine inquiries and transactions, it significantly reduces wait times

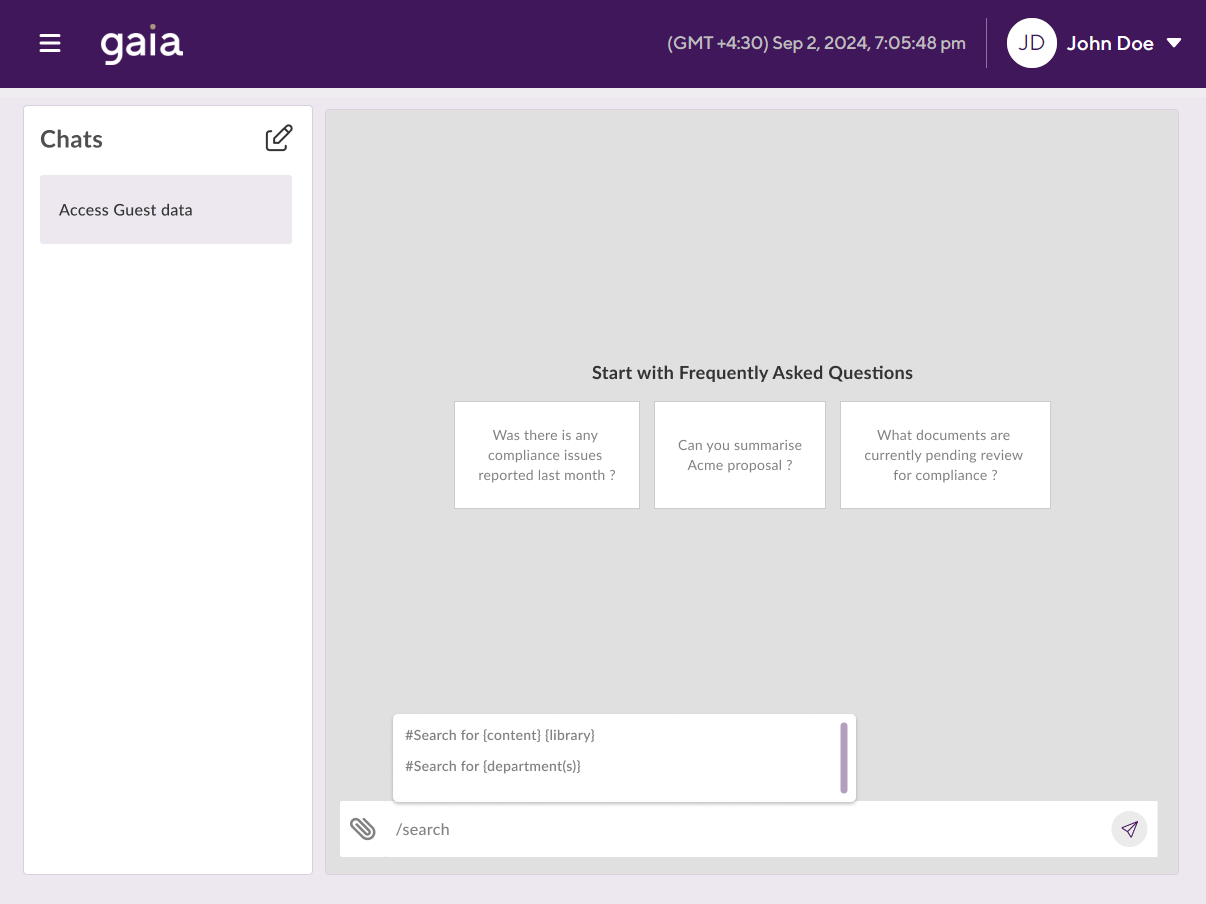

Gaia Pulse GenAI and LLM Staff Assistant

- Automated Document Summarization: Gaia Pulse generates concise summaries of lengthy documents

- Intelligent Information Retrieval: The platform implements AI-driven search functions that enable employees to swiftly locate relevant documents and resources across various databases

- Hosted in our client cloud infrastructure

For Staff Optimise resources, minimise admin

- Boost staff efficiency

- Build stronger customer relationships

- Maintain high brand standards

For Customers Seamless, yet personalised

- Enhanced security and trust

- Delightful in-branch experience across interactions

- Consistent service from all staff

Our Technology

Gaia platform

Gaia is a platform that uses AI and computer vision to authenticate customers, elevate their in-branch experiences and gain operational efficiency

- Gaia Connectors across systems (banking, appointment, etc.) and physical touchpoints

- GDPR compliant

- Auto-scalable with AWS cloud or private client cloud

Gaia app

The Gaia mobile app allows staff to recognize customers at concierge desks, providing relevant insights for a personalized service

- AI staff assistant for guest management

- Privacy-first guest recognition

- Issue management

- Voice-to-text for instant data input

Facial Recognition Cameras

Customer Recognition is performed either from Facial Recognition screens at teller counters or CCTV cameras at branch entrances. AI units can strengthen camera computing capacities for large facial databases. Data can be processed locally or on the cloud and be available immediately across branches.

- Edge or cloud computing with various camera types

- World's most secure end-to-end encryption (bank grade)

- Reliable even in challenging environments

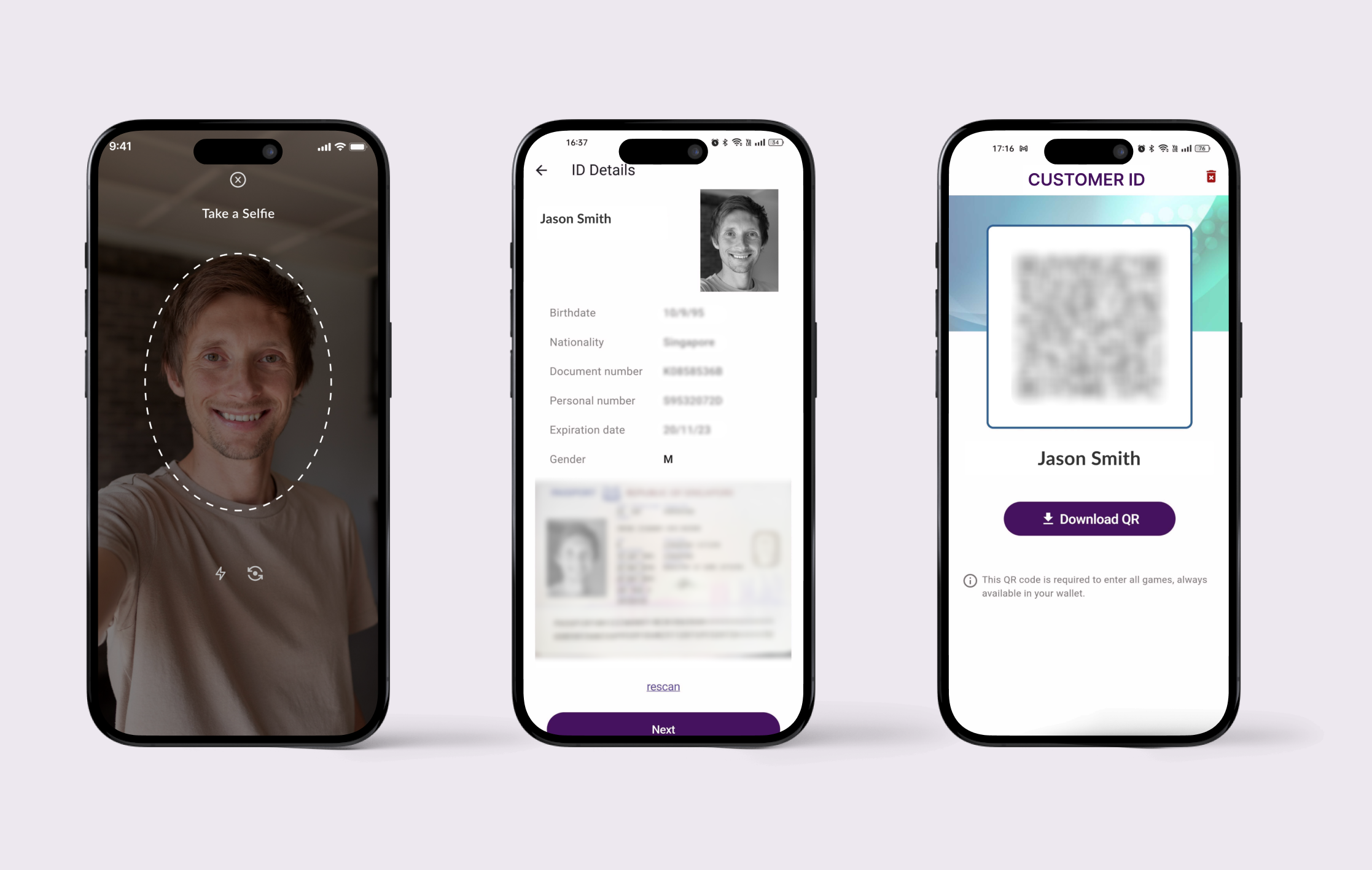

Gaia ID

The Gaia ID app matches customer selfie, identity document and phone number for a secure and reliable identity authentication.

- Face and document liveness detection

- Active authenticity control

- 13,000+ ID templates issued in 247 countries and territories

AI Avatar Kiosk

The AI Avatar Kiosk enables self-service through voice commands, facilitating effortless engagement with banking services and improving accessibility for individuals with disabilities

- AI staff assistant for guest management

- Built-in camera for customer segmentation

- Acoustic echo cancellation and voice tracking

- QR code scanner and printer

Our privacy-first architecture

Our architecture incorporates security and privacy by design, leveraging AWS global server regions, with the highest cloud security. Our company is SSLAB Rating A certified.

Drive Measurable

Results

50X

Faster checkins

20%

Daily efficiency gains

+45%

Satisfied customers

Scalable

Enterprise-grade security

Gaia's capabilities

scaled to your business

Customer Success See how businesses like yours deliver results with Gaia

Clients

At a glance

3Bn Sqf Field Tested

$120M Saved yearly through

automated workflows

600K Guest journeys created

on the Gaia platform

155 Locations covered

Frequently Asked Questions

Gaia Pulse is a Generative AI & LLM staff assistant for customer and knowledge management.

It empowers staff to efficiently retrieve information, answering questions like "Who is Jack Smith?" By streamlining data searches, Gaia Pulse enhances staff efficiency by reducing computer time and enabling more meaningful interactions with customers, all while keeping their profiles in mind.

Gaia Pulse knowledge management helps summarize documents, find information across document databases.

When multiple customers arrive simultaneously, our system ensures efficient recognition and management. Customers are prioritized based on proximity to cameras or FR screens; the closest customer's profile appears first, followed by the second closest, and so on.

Additionally, staff receive customer names via voice alerts, along with a summary of each customer's profile and insights on their computers and devices. This streamlined process allows staff to quickly access important details, enabling them to spend less time searching customer details while personalising the service and building meaningful relationships.

The Gaia platform is fully compliant with GDPR regulations. As a data processor, we assist banks in obtaining customer consent, typically at the teller counter. The consent rate is around 90%, thanks to the customer benefits from a fast and personalised service.

You can either use Facial Recognition screens at teller counters or use your existing CCTV cameras for Customer Recognition if they meet these specific criteria: a minimum frame rate of 12 FPS, support for Real-Time Streaming Protocol (RTSP), even illumination of at least 200 lux, and a maximum frontal angle of +/- 15° for optimal image quality. If your cameras don't meet these criteria, we can advise camera models or provide cameras with built-in Facial Recognition.

The Customer Recognition solution helps staff gain awareness and provide hyper-care to customers entering the branch (banking profile, appointment, preferences, etc.), as their profile appear automatically on staff computers, tablets or phones. For customers, this creates the sensation of a red carpet being rolled out for them each time they enter a branch.

We can use existing CCTV cameras to register customers at teller counter, or customers can register through the banking app via our Gaia ID SDK.

Smart cameras enhance customer experience through seamless check-in, hyper-personalised service, unauthorised persons detection and queue management. They improve operational efficiency by monitoring occupancy and space usage. Additionally, they enhance safety with incident detection, emergency response capabilities. Additionally, they manage whitelist/blacklist entries for secure access and facilitate seamless staff identification, creating a safer and more efficient environment for all.

The Gaia Connectors have been connected to 15 types of systems (e.g. Customer profile, appointments, CRM, etc.) to streamline processes of customer identification and service hyper-personalisation.

We use AWS Shield Standard for DDoS Protection. For automatic detection and mitigation of volumetric network (OSI layer 3) and sophisticated application (layer 7).

We use AWS WAF 2 with all instances of server, Storage Service and API Gateway for: bad bot and scraper protection, SQL injection protection, cross-site scripting protection, scanner and probe protection, IP address whitelist/blacklist, known attacker protection and HTTP flood protection.

Along with Firewall Server, EC2 instances also have Security Group and ACLs. Security groups control both inbound and outbound traffic at the instance level, while ACLs act as a firewall for associated subnets, controlling both inbound and outbound traffic at the subnet level.

Getting started is easy. Follow these 3 simple steps:

- Contact Our Sales Team: Reach out to discuss your specific needs and explore the solutions that best fit your requirements.

- Choose Your Plan: Select a plan that aligns with your goals and budget.

- Setup Phase: The setup process typically takes 2-4 weeks, depending on the chosen solutions and touchpoints.

Our team is here to guide you every step of the way